Game theory

The repeated prisoner’s dilemma using the example of the European rail market leader

1. Market entry of new bus competitors into European passenger rail market and my Corporate Strategy role at the European rail market leader

The situation was in 2014, when I worked as an Analyst in Corporate Strategy at one of my previous employers (Firm X), the European passenger rail market leader.

At that time, my team and I had the responsibility to advice the Group CEO on developing competitive strategies against the European passenger rail market deregulation in 2013. The situation was that the passenger rail market in the European Union and Germany was deregulated and new competitors from the coach and bus transport industry came into the market and changed the industrial order.

In the following, I will apply the repeated prisoner’s dilemma on this situation in corporate strategy by first (3.1.) outlining the game of the repeated prisoner’s dilemma and second (3.2.) analysing the bus competitors’ market entry in terms of it.

2. Game theory: Repeated prisoner’s dilemma and its application on deregulation of European rail market

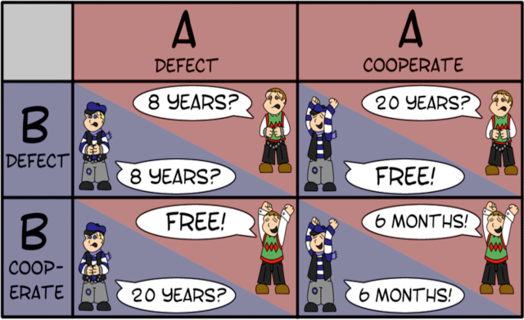

The repeated prisoner’s dilemma is a game, a framework, from the subject of game theory in which strategic interactions are analysed. In general, a game represents an abstract situation from a social context. More specifically, in the repeated prisoner’s dilemma the gain of one person’s action depends on the other person’s action.

A game consists of people, namely players, their achievable gains, called payoffs and the different strategies they can take.

The game is based on the assumption that all players are highly rational and want to achieve high outcomes. The players are also aware of the other players’ actions. The received payoffs depend on the other players actions and therefore one can deduce the actions of the players under specific conditions.²

These games can be applied in business situations in which it is necessary to predict the other players’ actions. It enables people in business to analyse interactions between the different market actors and to develop competitive strategies.

Specifically, in a situation in which a new competitor enters a market, the repeated prisoner’s dilemma helps to understand the dynamics of the upcoming competition. It analyses these competitive dynamics in form of an infinite repeated game in which the new competitor makes a move and the established market player responds.

In the following analysis, I will explain (3.1.) the actions and strategies of the transportation companies after the rail market liberalisation in 2013 in terms of the repeated prisoner’s dilemma and (3.2.) why both my Corporate Strategy team and the prisoner’s dilemma game failed to properly predict the outcomes.

3. Analysis of market entry of new bus competitors into European passenger rail market in terms of repeated prisoner’s dilemma

From other deregulated industries, we in the Corporate Strategy team were aware of the threat to enter into a price war with the new bus competitors which would have destroyed the rail industry’s profits in total. But on the other side, despite the long-term liberalisation announcement of the European Union, we were not capable to predict how the competition would change the level playing field.

In this case, the repeated prison’s dilemma helps to explain the outcomes of the established rail transport company (Firm X) and the bus company in the rail market liberalisation.

The repeated prisoner’s dilemma is a game in which trust and cooperative behaviour is established, if the game is played several times instead of non-cooperation if it is played one time.³ It shows strategies in which the bus companies entering the market tried to gain the most profitable routes and built their business model on lower operating costs to offer lower prices to passengers. Specifically, the game analysed how the bus companies entered the market and how Firm X defended or not itself.

3.1. Outcomes and strategies

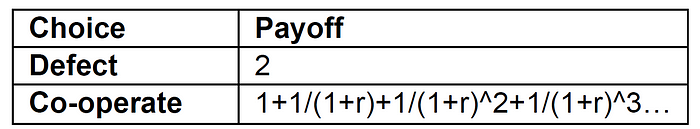

In the repeated prisoner’s dilemma, the players established the following trigger strategies. The interest rate of the bus and rail company were r.⁴

The trigger strategy of the bus company was to play cooperation. This meant that the bus company played cooperation in the first play and if the rail transportation company accepted its entry it played trust in the consecutive plays. If the transportation company played fight, then the bus company would have played distrust.

If the bus company played trust the rail transport company would have played accept but if the bus company played distrust, fight.

Rail company leaves bus company coexist but stays market leader via trigger strategy (Player 1 trust, Player 2 accept, Payoff 1,1)

If the bus company (Player 1) cooperated and played trust in the first round, Firm X (Player 2) could have played fight and thus could have gained an outcome of 2 but no additional payoff (Player 1 trust, Player 2 fight, Payoff -1,2).⁵

Instead the rail company achieved a total outcome of a net present value of (1 + (1/r))*1 when it accepted the entry of the bus company. Until r ≤ 1, then (1 + (1/r))1 would have been bigger or equal to 2. Consequently, the rail company had an incentive to accept instead of fight.

In the case that the rail company played its trigger strategy, the bus company had no incentive to distrust. This is because the bus company played trust first and knew that the rail company is accepting its entry. If the bus company would have played distrust, it would have got 0 in this move and nothing in the consecutive plays. This means that the bus company would not have play its trigger strategy and the rail company would not have had the chance to for any further plays.

Therefore, every time the rail company played its trigger strategy it was the best for the bus company to also play its.

In the case of r ≤ 1, the trigger strategies were a Nash equilibrium of the repeated game. That means that these were the best strategies of the players in front of the background of the strategies each other player played. In this case the only one Nash equilibrium was efficient.⁷

Consequently, my previous employer reacted tolerant because the market share gains of the specialised or niche bus company have seemed to be limited. The anticipated loss would have been even higher if the rail company would have fought against the entry in a battle via an expensive price war.

In this strategy the bus company was expected to gain a low market share and only due to a market increase, despite his lower cost base and first mover position. In general, Firm X should have stayed the dominant market player.

Firm X actively fights bus company entering market in final repeated game (Player 1 distrust, Player 2 fight, Payoff 0,0)

In the case if the repeated game was final and the companies would know that, there would be backward induction and none of the players would trust or cooperate, respectively.

In 2013 the transport companies did not know that the liberalisations of the rail market would have been significantly altered by a new regulation of the German government in 2019. The government incentivised rail for their lower CO2 gas emissions and thus Firm X significantly lowered its fares.

This knowledge of the finality of the game would have incentivised aggressive price wars and destroyed the passenger transportation industry’s profitability already from 2013 on. In this case the rail company would have fought back with fierce price competition, higher frequency and improved transport from the beginning on. The bus company would have had an incentive to enter the market at larger scale, more than that the rail company would in general have tolerated. This would have resulted in a reduction in outcomes for both competitors.

Takeover of market by bus company via distrust strategy (Player 1 distrust, Player 2 accept, Payoff 0,0)

If the demand would not have been increased by the entry of the bus company it could have been likely that the aggressive bus company would have taken control of the market. This would have been specifically the case if the rail company’s network advantage was weak or it had high cost disadvantages. Because the bus company knew that the rail company played its trigger strategy, the bus company seemed to not play distrust and aggressively enter the market because it did not seem that it had an incentive to do so.

3.2. Conclusion and critics

In conclusion, back in 2014 the Corporate Strategy team and the company decided to play its trigger strategy and to accept the entry of the bus company. But we and the repeated prisoner’s dilemma — as shown above — underestimated the aggressiveness of the bus companies. They quickly gained a significant market share of the passenger rail market in Germany and Europe until 2019. We might have also been overestimating the market leadership position of our Firm X in Europe, with our wide network and close to a monopoly position. This is crucial because besides the high profits a monopoly offers, we suffered from legacy such as inefficient operations and high costs. In addition, there was an elastic demand what meant that when the bus transport improved and their fares were lower, the passengers travelled more with busses than train.

A further critic is that the repeated prisoner’s dilemma and we in Corporate Strategy did not take into account that there is change in environmental factors. One big downside of the game is that it is static. We at that time did not take into account that payoffs of the bus company might change when the external factors changed. This could have been an additional error in our analysis.

For example, the demand might have changed and we have not taken this into account. When bus companies enter the market, a wider network of connections is offered and travellers might change their behaviour, for example change their means of transport to train or bus.

In 2019 the costs have also changed so that gains of the players differed. In the beginning bus companies had lower operating costs than the rail operator but it profited from economies of scale. But the payoffs then altered again when the train operators’ prices were subsidised by the government as this happened in Germany in 2019.

May previous employer had an advantage due to its vast network. The new entrant bus companies only operated on certain high-profitable routes in the beginning. The passengers in general liked seamless connectivity in travel, but if our Firm X closed down more and more unprofitable routes, too and the new entrants increased their network, the payoffs seemed to have altered.

Finally, it might have been the case that changes in prices changed the outcome significantly, specifically because passengers were price sensitive. From 2013 on the bus companies lowered the fares constantly and specifically, young price sensitive students then switched more from train to bus.

4. References

[1] Kamiar Mohaddes, MBA1 Microeconomics Introduction to Game Theory (2020), p. 53

[2] Kamiar Mohaddes, MBA1 Microeconomics Introduction to Game Theory (2020), p. 11

[3] Kamiar Mohaddes, MBA1 Microeconomics Introduction to Game Theory (2020), p. 53

[4] Kamiar Mohaddes, MBA1 Microeconomics Introduction to Game Theory (2020), p. 55f

[5] Kamiar Mohaddes, MBA1 Microeconomics Introduction to Game Theory (2020), p. 55f

[6] Kamiar Mohaddes, MBA1 Microeconomics Introduction to Game Theory (2020), p. 55

[7] John Forbes Nash, Non-cooperative games. Dissertation, Princeton University (1950), p. 1

Thanks for reading! Liked the author?

If you’re keen to read more of my Leadership Series writing, you’ll find all articles of this weekly newsletter here.