Cost Leadership and Growth Strategy

How a recognized surfboard manufacturer established a competitive advantage by having the lowest cost of operation and growing outside their core capabilities

In this consulting project, I advised the CEO of a world-wide recognized manufacturer of surfboards on how to achieve cost leadership in the industry and diversify into the snowboard sector. The CEO of the recognized surfboard manufacturer which originally began as a small shop opened in Sydney, 1958, continued to innovate the most advanced designs. The manufacturer of surfboards’ extensive customization options and award-winning surfboard models have made it one of the top surfboard brands.

Now, as surfing becomes a popular sport in Australia, there are increasing environmental concerns regarding the surfboard construction that majorly use polyurethane, a toxic and non-biodegradable material. This leads to the emergence of a start-up venture which uses more sustainable and less toxic materials to produce their surfboards. However, compared to the traditional PU boards, the new materials make the boards heavier, less flexible, and harder to control by surfers. The boards made with the new materials also have lower impact resistance i.e., they will be more easily broken by strong currents. Noticing these shortcomings, the R&D team of the start-up venture is working hard to address these issues. They believe that these problems will be solved in the near future, while keeping their use of the more eco-friendly materials.

1. Cost Leadership Strategy

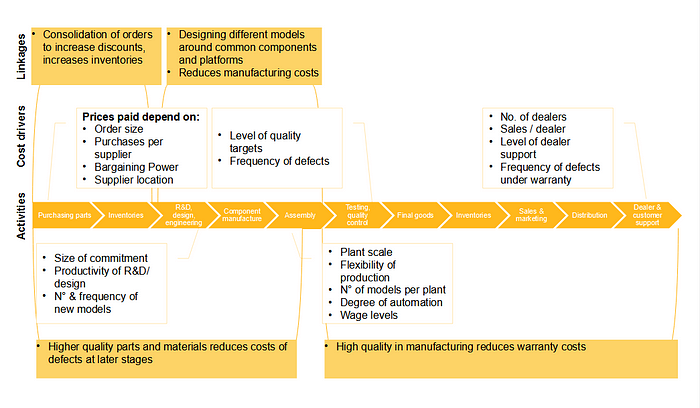

The CEO asked me what my strategy for the surfboard manufacturer based on cost would be and how she could achieve cost leadership. To analyse the cost leadership strategy for the surfboard manufacturer, I used the Value Chain framework. The framework helps to establish the costs relative importance, identify cost drivers, linkages, and opportunities for reducing costs.

My strategy for the surfboard manufacturer based on cost would be to achieve a long-term viable cost position in an increasingly difficult industry. This would mean that the CEO should build on the experience effect the company already has and further leverage it. The experience effect means that they could reduce their costs the more experience they have in manufacturing. This is based on the fact that the company is a world-wide recognized manufacturer of surfboards and has a talented team of experienced board shapers.

To achieve cost leadership, I would specifically focus on the Key Success Factors and avoid a price war-commodity.

- First, to purchase board materials, I would consolidate orders to increase discounts and use higher quality materials to reduce cost of defects.

- Second, for R&D, I would implement a platform strategy to reduce manufacturing costs — not contributing on customization, but only in the visible board parts.

- Third, for the quality control, I would build on the already high quality in manufacturing to reduce repair costs.

2. Cost Leadership implementation

The CEO asked me what my recommendations in terms of the implementation of surfboard manufacturer’s cost leadership strategy would be. She asked what the key principles surfboard manufacturers should rely on are. My recommendation in terms of the implementation of the surfboard manufacturer’s strategy is to be cautious about the external, internal, and dynamic consistency. The firm should rely on the concepts of the 3 Tests of a Good Strategy: internal consistency, external consistency, and dynamic consistency.

- Internal consistency. For internal consistency this means that decisions about sourcing, manufacturing, marketing, and distribution are related to one another. Consequently, a successful strategy has to be incorporated by the whole company.

- External consistency. The external consistency should be assured to that extend that the external threat of the new competition is properly addressed by the new cost leadership strategy.

- Dynamic consistency. Finally, the dynamic consistency forces the surfboard manufacturer to build on its past to carry out the cost leadership strategy. The knowledge in craftsmanship gives them the foundation to built high quality. In addition, the new product line for the mass market has shown the CEO that a platform strategy can be the next step.

3. Growth Strategy

The CEO asked for recommendations what the different growth strategies for surfboard manufacturers are. She asked me to assess the opportunity of her diversification into the snowboard sector and whether I would recommend it and why The strategies for surfboard manufacturers are to grow either in value or volume. I would recommend the surfboard manufacturer to grow in value rather than to grow in volume because the later has the risk to become a growth/price war-commodity.

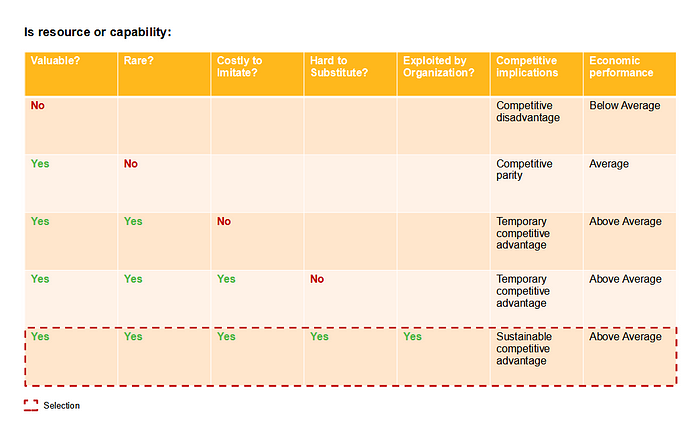

To assess the opportunity of their diversification into the snowboard sector, I used the VRI(S)O Framework. The framework analysis the company’s Core Capabilities and reveals the opportunities to create a Corporate Advantage by diversifying from their core.

Value. The opportunity of the diversification into the snowboard market, shows that the organisation’s capabilities of high quality boards enhance the value proposition for the customers in the snowboard market.

Rareness. The exclusivity of hand-crafted snowboards would give the surfboard manufacturer an advantage over others which do not already own the capabilities.

Inimitability. The inimitability of the craftmenship, the highly skilled resources would mean that the competitors cannot duplicate the organization’s capabilities of manufacturing the new snowboards without a cost disadvantage.

Substitutability. The market research shows that not yet alternatives to the organization’s capabilities for the new craftsmanship snowboards exist.

Organization. The analysis shows that the current activities operated by the surfboard manufacturer do not fully exploit the potential of its capabilities and there would be space for manufacturing snowboards.

In conclusion, I would recommend the surfboard manufacturer to further follow its successful growth strategy based on the diversification over the last years and move into the snowboard market.

4. Competitive Threat

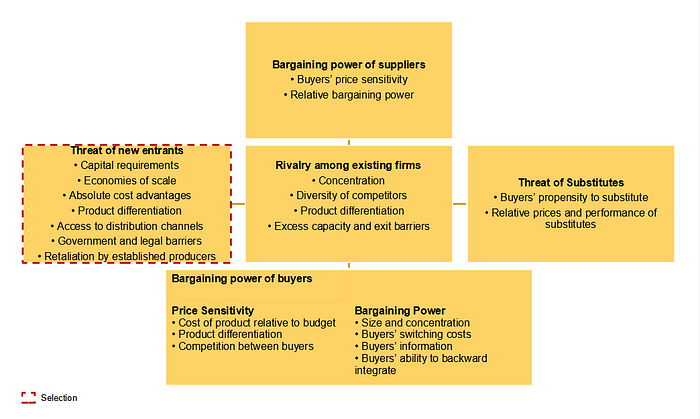

The CEO asked me to assess the threat of the start-up venture. She asked for advice which response the surfboard manufacturer should adopt in response to this threat and why. To analysis the threat of a new market entrant, the start-up venture, I used the framework Porter’s “Five Forces” and limited myself to the force Threat of new entrants.

The threat of the new entrant, the start-up venture, is immanent. The threat builds on the new societal trend of environment and sustainability (“Greta Effect”) and will increase in the next years. It is fostered by the society, government, and politics.

To respond to the threat, I would recommend the CEO of the surfboard manufacturer to move into the same space, adopt its materials, change the marketing to eco-friendly, and leverage their craftsmanship and high-quality perception. This would mean to build defence against the competitive force and exploit the industry change by spotting and claiming a promising new eco-friendly strategic positioning and even shaping the industry structure in ecological surfboards.

Thanks for reading! Liked the author?

If you’re keen to read more of my Leadership Series writing, subscribe and get an email whenever I publish an article of this weekly newsletter.