Four steps to assess the Shared Value Innovation “Reliance Village Access”

Venture analysis — Four steps to assess whether the Shared Value Innovation “Reliance Village Access — Reconnect our villages” is suitable for investment

1. Introduction

This venture analysis evaluates whether I would invest in the Shared Value Innovation “Reliance Village Access — Reconnect our villages” given the opportunity and the resources to do so (see Fig. 1).

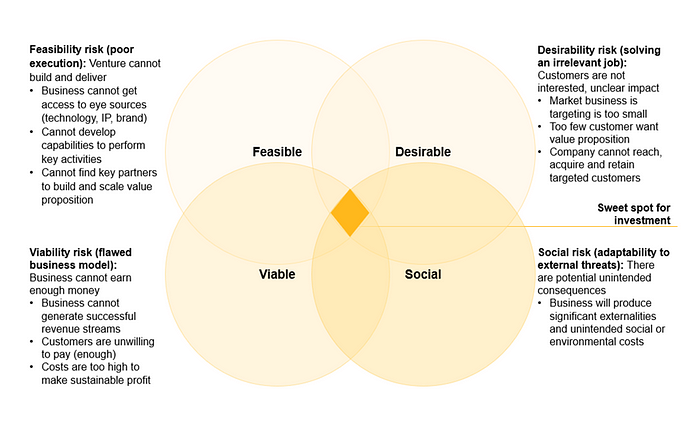

In the following, I will apply the Testing Business Ideas framework of Bland et al.² which I adapted to the model of Shared Value Innovation and Responsible Innovation to assess the team’s value proposition and business model (see Fig. 2)³. The adapted framework uses four types of risks as assessment criteria of the business model patterns to maximize returns and compete beyond product, price, and technology: infrastructure (feasibility), market (desirability), financial (viability), and “unknown risk” (social).

To test the business model, I will first analyse it broken down in smaller hypotheses to prove or refute the underlying assumptions of the business model. The adapted framework contains four hypotheses which match the Business model Canvas⁵: Firstly, that customers are not interested in the team’s idea (desirability hypotheses). Secondly, that the team cannot build and deliver their idea (feasibility). Thirdly, that the group cannot earn enough money from their idea (viability). Fourthly, that the business produces potential unintended consequences (social). Second, I will use experiments to further analyse the business model and therefore, reduce the risk and uncertainty of the investment decision. Third, I will put that learning from the experiments into an informed investment decision. Fourth, I will assess the business idea along the concept of Responsible Innovation.

2. Test — Hypotheses

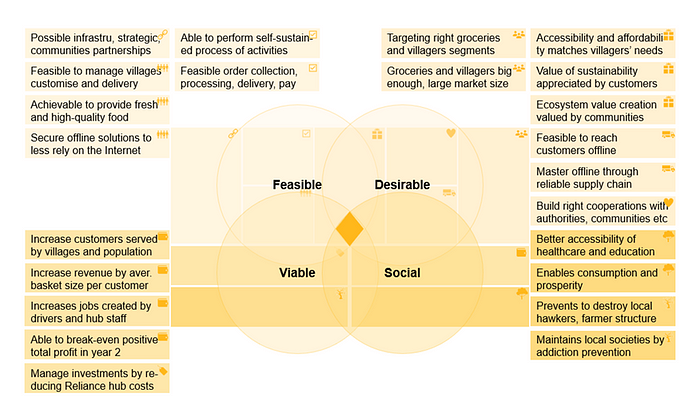

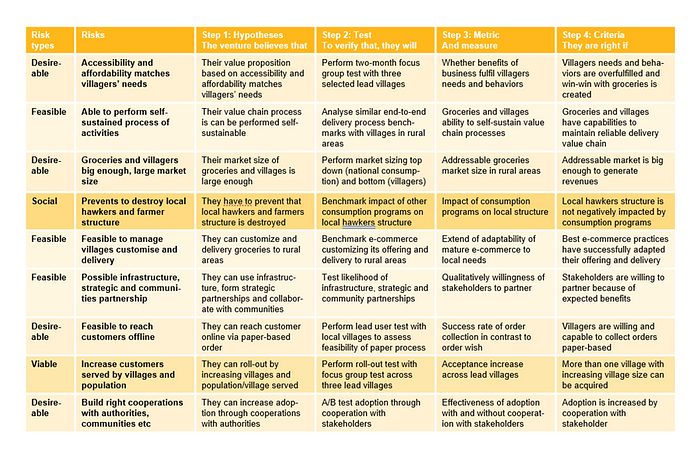

To assess the venture idea, I broke the business model down into smaller hypotheses to prove or refute the underlying assumptions. The adapted framework comprises four types of hypotheses which correspond to the risk types (see Fig. 3): the infrastructure risk measured by the feasibility hypotheses, the market risk by desirability hypotheses, the financial risk by the viability hypotheses, and the “unknown risk” by the social hypotheses.

To sum up, I can conclude that firstly several assumptions underly the venture’s desirability hypotheses. Therefore, there is a relatively high market risk for the business to both attract significant customer demand and create significant impact. Secondly, regarding the business idea’s feasibility, I mapped out a fewer number of assumptions. Consequently, there is a higher likelihood that the business can source the key resources and partnerships which are needed to pull off the proposed solution. Thirdly, to analysing the business model’s viability, I found fewer assumptions that risk the venture to achieve a sufficient EBITDA to remain competitive. Fourthly, by assessing the business’ social risk, I came to the conclusion that the business faces some externalities and unintended social and environmental costs which it might produce (“unknown unknowns”)⁷.

2.1. Prioritize Hypotheses

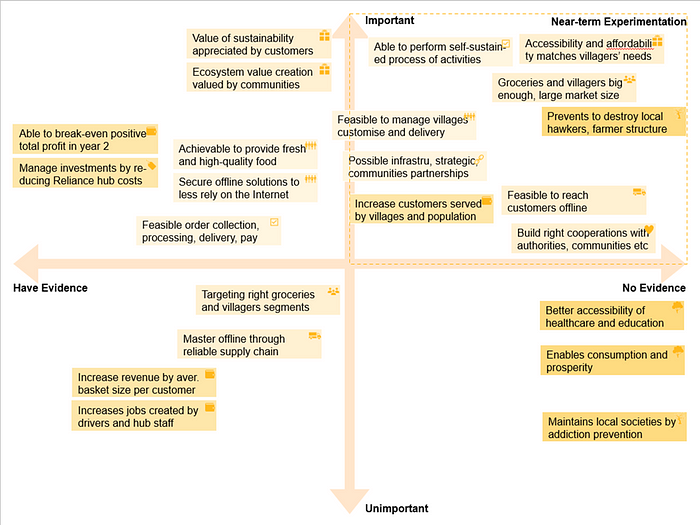

To identify the riskiest hypotheses, I prioritised the importance and existence or absence of evidence that supports the hypotheses (see Fig. 4)⁸. In the following, I focused on the hypothesis with most importance and light evidence because these assumptions would cause the team’s business to fail if they were falsified.

From all the risks which I made explicit in the form of hypotheses in the previous chapter, I prioritised nine of them to focus on in the next chapter, the near-term experimentation. Most of the risks are market and infrastructure risk types.

2.2. Market risk (Desirability hypotheses)

Firstly, the identified market risks lie within the value proposition, customer segment, channel, and customer relationship components of the Business Model Canvas. The market risk can be assessed by the desirability hypotheses. In general, I can state that there is a market risk because of the just big enough number of customers interested in the business solution and the only relative clear impact. The venture is targeting a probably big enough market and enough customers are likely to want the value proposition. The business seems to be able to reach, acquire, and retain the targeted customers.

Value Propositions

The venture believe that they have the right value propositions for the customer segments that they are targeting. Frist, they think that their proposition of accessibility and affordability and a reliable end-to-end grocery delivery matches to the needs of villagers.

Customer Segments

The team believes that the groceries and villagers segments they are targeting are big enough i.e., that there is a large potential market size.

Channels

They think that they have the right Offline channels to reach and acquire their customers and that they are feasible for rural areas.

Customer Relationships

They assume that they can build the right cooperation relationships with local stakeholders like authorities, community networks, etc.

2.3. Infrastructure risk (Feasibility hypothesis)

Secondly, the prioritised infrastructure risk is based on the business model components key partners, key activities, and key resources. The infrastructure risk can be assessed by the Feasibility Hypothesis. To sum up, I can say that there is a risk that the business cannot build and deliver the solution. The risk consists in the access to key sources, the development of capabilities to perform key activities and the acquisition of key partners to build and scale the value proposition.

Key Activities

The venture thinks that they can build a self-sustained process of activities. The activities are built on the assumption of feasible order collection, order processing, order delivery, and payment processing processes.

Key Resources

The business believes that they can manage all resources that are required to build their business model. Specifically, they think they can cover the addressable rural villages, customise their orders, and fulfil the door-to-door delivery.

Key Partners

They think that they can create the partnerships required to build our business. Especially, they assume that infrastructure is available, strategic partnerships are possible, and communities are willing to cooperate.

2.4. Financial risk (Viability hypotheses)

Thirdly, the financial risk consists of the revenue stream and cost structure. The financial risk can be examined by testing the viability hypotheses. To conclude, it is less likely that the financial risk causes an effect on my investment decision because the probability that the business cannot earn enough money is low. It seems that the venture can generate revenue streams, customers are willing to pay enough, and costs are not too high to make sustainable profit.

Revenue Streams

The venture thinks that they can generate revenues. This hypothesis is based on the assumption that they can increase the number of customers served over time by increasing the number of participating villages and the average population in a village.

2.5. “Unknown risks” (Social hypotheses)

Fourthly, the “unknown risks” lie within the Shared Value or Triple Bottom Line of the Business Model Canvas¹⁰. The “unknown unknowns” can be analysed by testing the social hypotheses. Generally speaking, there are view potential unintended consequences. The risk that the venture will produce significant externalities or unintended social and environmental costs is low.

Social and environment cost

The business believes that there is no significant impact of its idea that destroys the local hawkers and farmer structure in the rural areas.

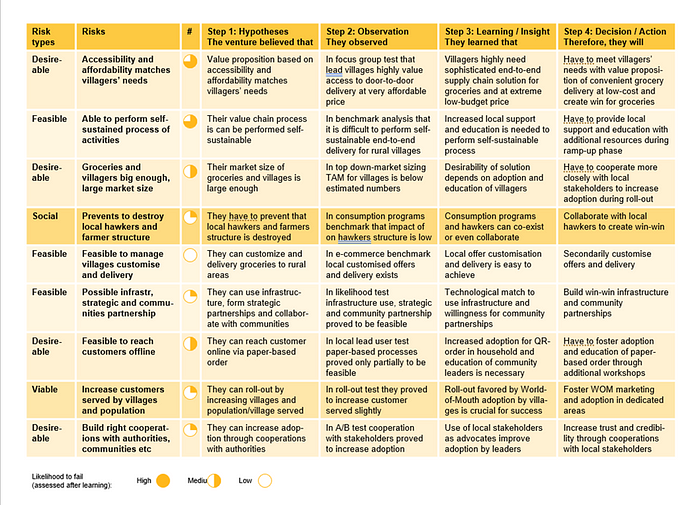

3. Test — Experiment

Second, I used business experiments to assess the risk and reduce the uncertainty of my investment decision in the Share Value business idea¹¹. In the following, I applied the Test Card framework of Strategyzer to provide evidence that supports or refutes the nine prioritised hypotheses (see Fig. 5)¹².

For the desirable hypothesis “Accessibility and affordability matches villagers’ needs”, I used the experiment of a focus group test and measure the success by fulfilment of the villagers’ needs by the benefits of the venture. I concluded that the criteria is met if the villagers needs are overfulfilled in a win-win relationship with the groceries.

In conclusion, for each of the nine hypotheses there is medium to strong evidence that the hypotheses can be accepted (see Fig. 6). However, the most important hypotheses with less evidence such as “Accessibility and affordability”, “Able to perform self-sustained process”, etc. require more evidence to meet the criteria to be accepted.

4. Test — Learn

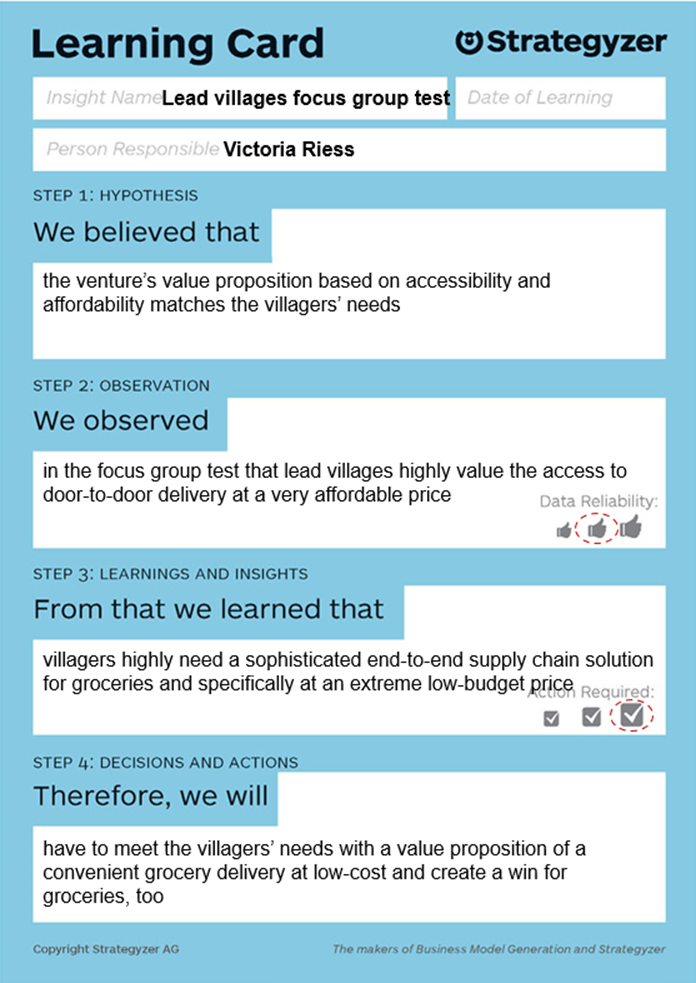

Third, to make an informed investment decision, I put that learning from the experiments into business insights. I applied the Learning Card framework from Strategyzer to accept or reject the nine hypotheses (see Fig. 7)¹⁴.

For the “Accessibility and affordability matches villagers’ needs” hypothesis, I observed in the focus group test that lead villages highly value the access to door-to-door delivery at a very affordable price. My learning is that rural villagers highly need the sophisticated end-to-end supply chain solution for groceries and at an extreme low-budget price. Therefore, the venture will have to meet the villagers’ needs with the value proposition of a convenient grocery delivery at a low-cost.

To conclude, most of the nine prioritised hypotheses bear only a small likelihood to fail (see Fig. 8). In contrast, the most important hypothesis without evidence are the most risky. However, the business insights provided by the experiments give profound evidence to make an investment decision.

5. Responsible Innovation

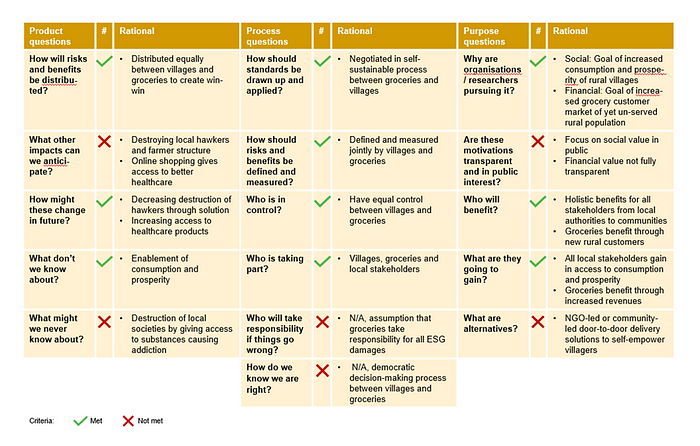

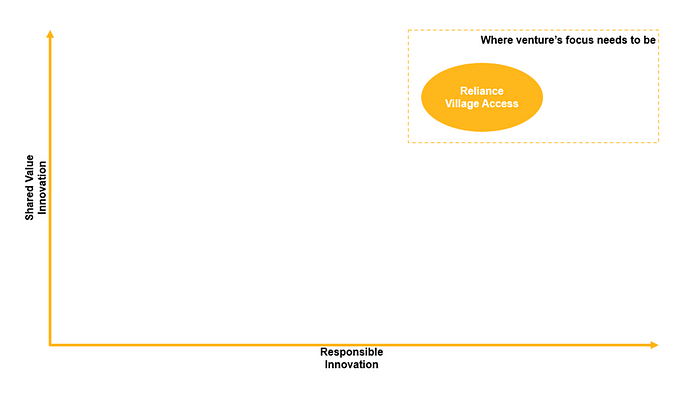

Fourthly, to make the investment decision one must assess whether Responsible Innovation is involved in the Shared Value Creation of the team. A Responsible Innovation is characterised by a “transparent, interactive process by which societal actors and innovators become mutually responsive to each other”¹⁶. The assessment criteria are the ethical acceptability, sustainability and societal desirability of the innovation process and products. In the following, I assessed the risk across the dimensions product, process, and purpose (see Fig. 9).

To sum up, the team’s Shared Value Innovation has only a few dimensions in which the criteria of a Responsible Innovation is not met. Despite the trend in seemingly well-intentioned Share Value efforts which are pursued irresponsibly, the venture shows that their focus is also on the process that was used to produce the observed outcomes (double bottom line, see Fig. 10).

6. Conclusion

In conclusion, I would invest in the Shared Value Innovation “Reliance Village Access — Reconnect our villages”. My decision is based on the above stated results of the venture analysis along the Testing Business Ideas framework. Frist, the from the business’ desirability viewpoint there is evidence — despite some risk — that the venture will attract significant customer demand from villagers and groceries, while responsibly creating significant social impact. Second, the feasibility analysis showed that the business can source the key resources and partnerships which are needed to launch the new solution. Third, from the viability assessment I can conclude that the business can achieve sufficient EBITDA to establish a competitive advantage. Finally, from a social risk analysis I can summarise that despite the fact that there are some unintended social costs these will not cause the business to fail.

7. References

[1] Grimes, M. (2021) Seminar Business and Society 1/8. Cambridge: University of Cambridge

[2] Bland, D., Osterwalder, A., Smith, A. and Papadakos, T. (2020) Testing business ideas (1st ed., Strategyzer series)

[3] Orton, K. (2017) Desirability, Feasibility, Viability: The Sweet Spot for Innovation. Retrieved from https://medium.com/innovation-sweet-spot/desirability-feasibility-viability-the-sweet-spot-for-innovation-d7946de2183c

[4] Pigneur, Y. (2016) Desirability, feasibility and viability of a business model. Retrieved from http://www2.hec.unil.ch/wpmu/ypigneur/2016/06/20/desirability-feasibility-and-viability-of-a-business-model/

[5] IDEO. How to Prototype a New Business. Retrieved from https://www.ideou.com/blogs/inspiration/how-to-prototype-a-new-business

[6] Bland, D., Osterwalder, A., Smith, A. and Papadakos, T. (2020) Testing business ideas (1st ed., Strategyzer series)

[7] Grimes, M. (2021) Seminar Business and Society 1/8. Cambridge: University of Cambridge

[8] Osterwalder, A. (2015) 5 Lean Startup Essentials to Reduce Risk and Uncertainty. Retrieved from https://www.strategyzer.com/blog/posts/2015/4/23/5-lean-startup-essentials-to-reduce-risk-and-uncertainty

[9] Bland, D., Osterwalder, A., Smith, A. and Papadakos, T. (2020) Testing business ideas (1st ed., Strategyzer series)

[10] Osterwalder, A. (2016) Why Companies Fail & How To Prevent It. Retrieved from https://www.strategyzer.com/blog/posts/2016/6/20/why-companies-fail-how-to-prevent-it

[11] Osterwalder, A. (2017) How To Systematically Reduce The Risk & Uncertainty Of New Ideas. Retrieved from https://www.strategyzer.com/blog/posts/2017/12/6/how-to-systematically-reduce-the-risk-uncertainty-of-new-ideas

[12] Bland, D., Osterwalder, A., Smith, A. and Papadakos, T. (2020) Testing business ideas (1st ed., Strategyzer series)

[13] Bland, D., Osterwalder, A., Smith, A. and Papadakos, T. (2020) Testing business ideas (1st ed., Strategyzer series)

[14] Bland, D., Osterwalder, A., Smith, A. and Papadakos, T. (2020) Testing business ideas (1st ed., Strategyzer series)

[15] Bland, D., Osterwalder, A., Smith, A. and Papadakos, T. (2020) Testing business ideas (1st ed., Strategyzer series)

[16] Schomberg, R. (2014) The Quest for the ‘Right’ Impacts of Science and Technology: A Framework for Responsible Research and Innovation

[17] Grimes, M. (2021) Seminar Business and Society 1/8. Cambridge: University of Cambridge

[18] Grimes, M. (2021) Seminar Business and Society 1/8. Cambridge: University of Cambridge

Thanks for reading! Liked the author?

If you’re keen to read more of my Leadership Series writing, you’ll find all articles of this weekly newsletter here.