How to develop the Strategic Portfolio Design for leading industrial enterprises holding company

The new CEO of one of the worldwide leading industrial enterprises and service companies tasked me with the development of the new Strategic Portfolio Design for the Group

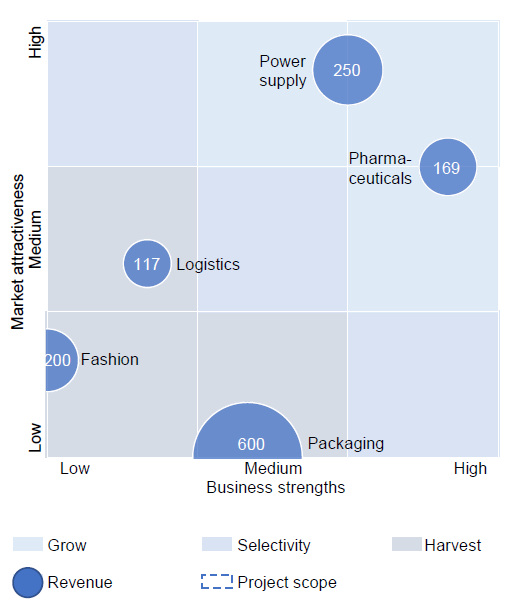

The business activities of XYZ AG, which is based in Germany, are the investment in industrial enterprises and service companies. Currently there are investments in the areas of pharmaceuticals, logistics, fashion, electricity supply and packaging. Sales in 2017 amounted to around €1.3 billion. XYZ AG employs a total of 8,500 employees. The earnings situation in the Group as a whole is stable, although the situation in the individual situation in the individual business units varies considerably.

1. Problem

Due to a change in management, fundamental portfolio strategy issues have come to the fore. questions have come to the fore. In a preliminary discussion I had with the new CEO the following issues were raised.

- The owners demand a significant increase in earnings in the next few years. years. The new management has doubts as to whether this is feasible with the existing existing shareholdings. For this reason, a critical review of the earnings potential of the portfolio companies is to be carried out. On the other hand, options for the further development of the investment portfolio are to be worked out.

- In the past, the portfolio companies were managed very autonomously. Against this backdrop, there are repeated discussions about the sense of a holding structure. The new management therefore also wants to look at the future organizational structure and the role of the parent company.

- The owners have already indicated to the management that an IPO is planned in the medium term. that an IPO is planned in the medium term. There is uncertainty in the new management board about what this means for the future management of the subsidiaries. Up to now targets and performance measurement have been based on the figures from external external accounting figures.

- Finally, the new CEO has indicated that the relationship between the XYZ AG Management Board and the boards of the subsidiaries is not the best. For this reason, thought is to be given to how the management boards of the subsidiaries can be won over to the project.

2. Initial situation

From my analysis, I synthesized that the XYZ holding has stable earnings, despite different portfolio performance, autonomous subsidiaries’ management, bottom-up performance measurement and adversarial relationships.

- Stable earnings situation, despite differences in portfolio performance: Pharmaceuticals & power supply yield high returns, logistics and packaging ambiguous, fashion performs poorly

- Autonomous management of subsidiaries due to financial holding structure

- Bottom-up performance measurement set within external accounting process

- Adversarial relationships between management of holding and its subsidiaries

3. Project approach

I recommended the CEO that XYZ AG should increase their earnings by investing, diversifying, divesting, re-develop into an active management holding and regain direct influence and tie compensation to project initiatives.

- Invest in pharmaceuticals and power supply, diversify into new medical online business; grow contract logistics; divest in fashion

- Re-develop organization from passive financial into active management holding to prepare partial IPO of packaging business

- Regain direct influence by upstream goal-setting and top-down planning process to shape future, substantially different from reporting

- Tie evaluation and compensation of subsidiaries‘ management to progress of portfolio strategy initiatives

4. Workstream plan

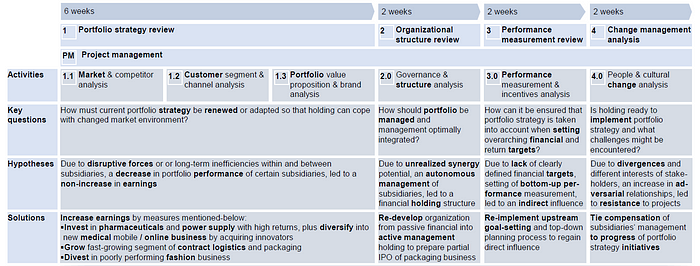

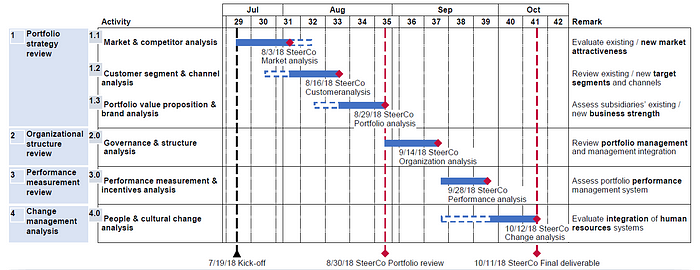

I recommended the CEO a 4-step project approach: (1) review of market and portfolio, (2) organizational portfolio management, (3) portfolio performance management and (4) HR systems integration.

4-step strategic portfolio design project approach, 12 weeks:

- External market analysis and portfolio strengths analysis

- Organizational management analysis

- Performance management analysis

- Change management through HR systems integration

- Quality of final deliverable ensured through high-level business case, high-level roadmap (next steps, responsibilities, required decisions) and recommendation regarding way forward

5. Project resources

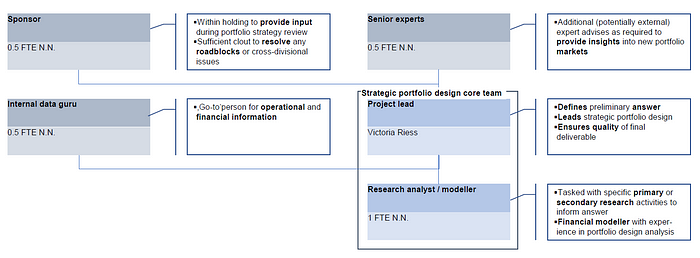

The 3.5 FTE dedicated project resources should be allocated on strategic portfolio design: 1.5 FTE holding resources, plus 2 FTE core team members.

- 1.5 FTE holding resources allocated to strategic portfolio review:

- Project sponsor as member of senior management team to oversee portfolio review

- Allocated internal resource with good understanding of holding‘s operational and financial data

- As review involves new digital market advisers with expertise in area to add significant value

- Core team structure involves project lead, typically full-time, plus potentially 1 or more supporting analysts / modellers

Thanks for reading! Liked the author?

If you’re keen to read more of my Leadership Series writing, subscribe and get an email whenever I publish an article of this weekly newsletter.